Guide to accounting APIs and integrations

Editor's note: This is a series on API-based integrations. Check out Merge if you're looking to add 10+ accounting integrations with one accounting API.

It’s no secret the accounting and fintech landscape is changing. 77% of finance professionals recognize that most of their basic accounting operations can be fully automated, and more and more are looking for ways to make their work more impactful through analytics, data visualization, and better tooling (source).

In short: SaaS automation is a must-have for the industry, and integrations help make that SaaS automation a reality.

Accounting integrations—the ability for your product to read and write data to the accounting software that your customers use—can drive revenue and cut costs for your business. They can also derail your product roadmap and add more strain on your engineering and customer success teams.

Read on in this Guide to Accounting APIs to learn about:

- Top accounting APIs - Which accounting systems are most popular

- Key concepts - How accounting systems work

- Data schemas - How accounting data is organized

- Use cases - Common ways accounting data is used in product integrations

- How to get started - Approaching accounting API integrations within your own product

Related: What ERP API integration?

Top Accounting APIs

The accounting software market is divided into two worlds: Small and Medium Business (SMB), and Enterprise Resource Planning (ERP).

SMB software, such as QuickBooks, handles core accounting processes for businesses, often small teams to medium operations. ERP software handles core accounting, as well as detailed order tracking, logging, and supply chain data. Examples include Oracle NetSuite and Microsoft Dynamics.

Below are the rankings of the top accounting platforms, by number of customers.

Related: A look at the top accounting APIs

Key Accounting API Concepts for Developers

References classify the parties and goods involved in a transaction such as accounts, contacts, or items by indicating who is selling or buying a product and what the product is.

Transactions record money movement, such as journal entries or invoices, and often include data fields for References to show the major parties involved in the transaction.

Reports—such as Balance Sheets, Income Statements, and Cash Flow Statements—examine all the transactions of a company, classify those transactions into relevant categories, such as assets or liabilities, and can be used to draw conclusions about the company’s financial health.

Multi-Entity accounting occurs when a corporation has subsidiaries (or works across multiple locations) and has multiple subsidiaries or ‘entities’ that it needs to account for. Accounting platforms recognize this by organizing accounting data into different entities. Entities are usually organized into a hierarchy of parent and child entities, and all accounting data is tied to a specific entity - each account, transaction, contact, tracking category etc. is a part of an entity. This is important because it allows teams to clearly delineate who owns what when it comes to assets, liabilities, and equity of various organizations.

Consolidation is the reconciliation process when a company's business spans multiple countries (and currencies) and those currencies must be reconciled into a single currency for bookkeeping. Different accounting providers handle this differently. For example, Sage and NetSuite have multiple objects for currency and consolidation (NetSuite has three; Sage Intacct has five).

If you want a more expansive refresher on accounting terminology, then read through our Guide to Core Accounting Concepts.

Accounting API Data Schemas

Companies are a top level concept for organizing accounting information. Company objects are used to represent the organization to which a set of Accounts belongs. Contacts represent counterparties such as vendors and customers.

Accounts are used to track transactions and exist in a hierarchy in the general ledger for a given Company. They may include revenue, expenses, assets, liabilities, or other items.

Several types of reports are available via an accounting API. Balance Sheets record assets, liabilities, and equity. Cash Flow Statements record operating, investing, and financing activities. Income Statements record income, cost of sales, and expenses. These reports are typically organized in tabular fashion, with rows and columns of data.

Transactions record activities between a Company and Contacts. Specific types of Transactions include Expenses, Credit Notes (accounts payables refunds), Vendor Credit (accounts receivables refunds), Invoices, Purchase Orders, and Journal Entries. Transactions include a date, amount, and one or more Line Items. These Line Items are associated to Items that represent specific goods or services that make up a Transaction.

Transactions, Line Items, and Items can have Tracking Categories that are used to categories which business unit, department, subsidiary, or other organizational structure is related to a record.

Top Accounting API Use Cases

Forecast and Analyze Financial Performance

Financial planning and analysis software leverage integrates with accounting systems to forecast financial metrics, provide financial dashboards, and track historical performance.

Examples: Chart Mogul, Fathom, Finmark, Float, Jirav, Standard Metrics, Syft Analytics

Related: Common ways to use financial statement APIs

Track Receivables and Revenue

Ecommerce and subscription revenue applications integrate with accounting systems to track and update invoices, making it easier to record revenue and manage account receivables.

Examples: BigCommerce, Chargebee, Invoice2Go

Track Payables and Expenses by Category

Spend and expense management software integrates with accounting systems to track expenses, categorize them, remove manual data entry, and manage account payables.

Examples: Airwallex, Bill.com, Brex, Concur, Expensify, Payhawk, Ramp, Tipalti

Related: Common accounting integration examples

Make or Request Payments

Payment platforms integrate with account systems to set up one-time or recurring payments and match payments to invoices.

Examples: Lightspeed, Paypal, Square, Stripe

Evaluate Creditworthiness

A wide variety of banking, lending, trade and inventory finance, and other financial services rely on creditworthiness data from income statements, balance sheets, and cash flow statements.

Examples: Bluevine, Fundbox

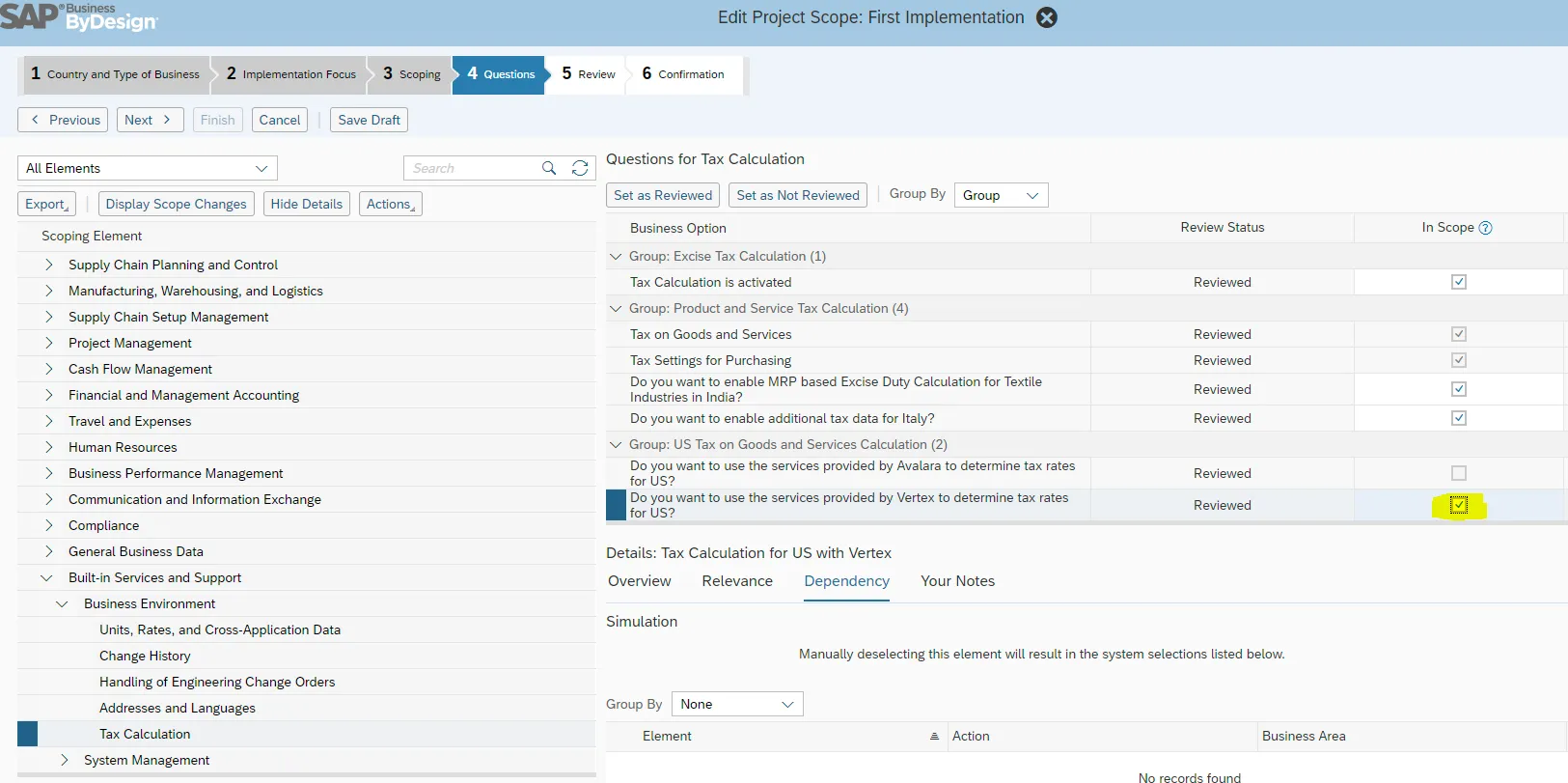

Prepare Taxes and Tax Credits

Global taxes are complex and ever changing, making tax compliance software a common integration point for accounting systems.

Examples: Avalara, Paddle, Sovos, Vertex

Related: A guide to tax rate APIs

Getting Started with Accounting APIs

Once you’re ready to kick the tires integrating with an accounting provider, you’ll want to keep in mind a few additional topics:

- API format - Which standards do the underlying APIs support (REST, SOAP, etc.)

- Authentication - Which auth methods each API uses (e.g. OAuth, basic auth, etc.)

- Pagination and rate limits - How large responses are accessed in each API

- Test Accounts - How to access sandboxes for each API

We’ve built Merge to help developers easily integrate with multiple accounting systems. Our Unified Accounting API is all REST-based, with one type of authentication, pagination, rate limiting, and automated issue detection to make development simple. Hundreds of companies use Merge to plug into accounting APIs, including Causal.

For all of this info in one comprehensive place, plus more in-depth examples of accounting integrations, download the Guide to Accounting APIs and Integrations.

.png)

.png)